Tricia Suvari, Esq. | | (1) | Mr. Jeffrey Farrow joined the Company as Chief Financial Officer on April 4, 2016. |

(2)59 | Ms.Tricia Suvari joined the Company as | | Chief Legal Officer on October 11, 2016. |

(3) | Dr. Hing Sham was appointed as Senior Vice President, Research effective as of May 1, 2016. |

(4) | Mr. Radovich was appointed as Senior Vice President, Operations effective as of September 1, 2016. |

Executive Officers The biographies of our executive officers, other than Dr. Love, whose biography is set forth above, appear below. JeffreyFarrow has served as our Chief Financial Officer since April 2016. Mr. Farrow previously served as chief financial officer of ZS Pharma, Inc., a biopharmaceutical company, which was acquired by AstraZeneca in December 2015. Prior to ZS Pharma, he served as the chief financial officer at Hyperion Therapeutics, Inc., a commercial pharmaceutical company, from July 2010 until May 2015 where he was part of the team responsible for the successful regulatory approval and commercial launch of RAVICTI® for the treatment of urea cycle disorders. He previously served as vice president of finance at Evotec AG, a drug discovery and development company. Prior to Evotec, Mr. Farrow served as vice president of finance and chief accounting officer at Renovis, Inc., a drug discovery and development company, which was acquired by Evotec AG. Earlier in his career, Mr. Farrow spent seven years working in the audit practice of KPMG LLP. Mr. Farrow holds a B.A. in business administration with a concentration in corporate finance from California State University at Fullerton and is a certified public accountant (inactive). TriciaSuvari,Esq,Brian Cathers, Ph.D. has served as our Chief LegalScientific Officer since October 2016. From May 2000 until June 2009, Ms. SuvariFebruary 2019. Dr. Cathers previously served in several senior rolesas executive director and head of drug discovery at CV Therapeutics, Inc., a biopharmaceutical company (acquired by Gilead Sciences, Inc. in 2009), ultimatelyCelgene Corporation, or Celgene, from November 2015 to February 2019, and as senior vice president, general counseldirector of biochemistry and chief compliance officer of CV Therapeutics.structural biology at Celgene from October 2013 to November 2015. At Celegene, Dr. Cathers’ teams produced eight new development candidates and advanced five investigational drugs into clinical testing. Prior to CV Therapeutics, from May 1991 until May 2000, shejoining Celgene, Dr. Cathers served as corporate counselsenior group leader and director at Genentech,NewBiotics, Inc., in increasingly senior roles. From February 2012 until July 2016, Ms. Suvari served as a vice president and general counsel at thenon-profit Peninsula Open Space Trust, and from early 2011August 2000 to February 2012 she2004, where he oversaw enzymology and biophysical chemistry research, and was part of small team that developed a colorectal cancer drug from basic research to clinical testing. Prior to joining NewBiotics, he served as an independent consultant supporting biopharmaceutical companies. Ms. Suvari earned her Bachelor of Sciences degreeenzymologist at Axys Pharmaceuticals. Dr. Cathers holds a B.S. in Geology and Geophysicschemistry from YaleEmporia State University and her J.D. degreean M.S. and Ph.D. in medicinal chemistry from Harvard Law School.the University of Kansas.

JungE.Choi has served as our Chief Business and Strategy Officer since April 2015. From April 2014 to March 2015, Ms. Choi served as senior vice president, corporate development for InterMune, Inc., a biotechnology company (acquired by Roche Holding AG in 2014), and served as an adviser on strategy and business development to InterMune from March 2013 to April 2014. Prior to joining InterMune, from February 2011 to March 2013, Ms. Choi led corporate and business development for Chimerix, Inc., a biopharmaceutical company, as a consultant and senior vice president, corporate development. Prior to that, from August 2001 to August 2010, Ms. Choi held various management positions at Gilead Sciences, Inc., a biopharmaceutical company, including leadership of business development, licensing, and mergers and acquisition activities. During her tenure at Gilead Sciences, Ms. Choi built and oversaw the corporate development group, and led the U.S. commercial launch of Hepsera® for the treatment of the hepatitis B virus. Ms. Choi holds a B.A. in human biology and an M.B.A. from Stanford University. HingEric Fink was appointed our Chief Human Resources Officer in August 2019. Prior to joining us, from 2010 until July 2019, he most recently served as Vice President, Human Resources, at Jazz Pharmaceuticals, a global biopharmaceutical company. While there, he held a variety of human resource senior leadership positions to develop human capital and organizational development strategies and scale the global HR operating model to better serve the expanding business. From 2008 to 2009, he held a leadership position in the sales training organization at Bayer Healthcare, a multinational pharmaceutical and life sciences company. From 1999 to 2008, he held various roles at GlaxoSmithKline, a global healthcare company, across a wide spectrum of the U.S. commercial function, including Sales, Sales Training, Commercial Analytics, and Sales Management. He received a B.S. in Biology from Pennsylvania State University and an M.S. in Organizational Leadership from Mercyhurst University.

Sham,Ph.D.David L. Johnson has served as our Chief Commercial Officer since March 2018. From October 2003 until February 2018, Mr. Johnson served in roles of increasing responsibility in the commercial organization at Gilead Sciences, Inc., a biopharmaceutical company, ultimately as vice president, sales and marketing, for Gilead’s Liver Disease Business Unit. At Gilead, Mr. Johnson was responsible for the commercial launch of Gilead’s hepatitis C treatments Sovaldi®, Harvoni®, Epclusa® and Vosevi®, hepatitis B treatment Vemlidy®, and HIV treatments Complera® and Stribild®. Prior to Gilead, from April 1992 to September 2003, Mr. Johnson served in various roles in sales, product marketing, business development, global commercial strategy and portfolio development at GlaxoSmithKline PLC, a British pharmaceutical company. Mr. Johnson holds a B.A. in business marketing from the University of Puget Sound and an M.B.A. from the Kenan-Flagler Business School at the University of North Carolina.

Tricia Suvari, Esq., has served as our Chief Legal Officer since October 2016. From 2000 until 2009, Ms. Suvari served in several senior roles at CV Therapeutics, Inc., a biopharmaceutical company (acquired by Gilead Sciences, Inc. in 2009), ultimately as senior vice president, general counsel and chief compliance officer. Prior to CV Therapeutics, from 1991 until 2000, she served as corporate counsel at Genentech, Inc., in increasingly senior roles. From February 2012 until July 2016, Ms. Suvari served as a vice president and general counsel at thenon-profit Peninsula Open Space Trust, and from early 2011 to February 2012 she served as an independent consultant to biopharmaceutical companies. Ms. Suvari earned her Bachelor of Sciences degree in Geology and Geophysics from Yale University and her J.D. degree from Harvard Law School. EXECUTIVE COMPENSATION Compensation Discussion and Analysis This Compensation Discussion and Analysis, or CD&A, describes our executive compensation program and the 2019 compensation for: (i) each individual who served as our principal executive officer during 2019; (ii) each individual who served as our principal financial officer during 2019 and (iii) our three most highly compensated executive officers during 2019 other than the individuals set forth above in clauses (i) and (ii), all of whom we refer to collectively as our named executive officers, or NEOs. This CD&A should be read with the compensation tables and related disclosures for our NEOs. Our NEOs for 2019 were as follows: Ted W. Love, our President and Chief Executive Officer, or CEO; Jeffrey Farrow, our Chief Financial Officer; Brian Cathers, our Chief Scientific Officer; David L. Johnson, our Chief Commercial Officer; and Joshua Lehrer-Graiwer, our former Chief Medical Officer. Management Changes in 2019 and 2020 We hired Dr. Cathers in February 2019. On September 17, 2019, our Board of Directors appointed Dr. Lehrer-Graiwer as our Chief Medical Officer, effective October 1, 2019. Prior to his appointment as our Chief Medical Officer, Dr. Lehrer Graiwer served as our Senior Vice President, Research, since May 2016. He was Senior Vice President, Chemistry,Clinical Development. In February 2020, Dr. Lehrer-Graiwer resigned from July 2014 tohis employment with our company, effective April 2016. Most recently, from January 2013 to July 2014, Dr. Sham served as head of research and development at iOneWorldHealth/Path.org (PATH), anon-profit pharmaceutical development organization. Prior to that, from September 2006 to November 2012, he served as senior vice president of research and head of chemical sciences at Elan Pharmaceuticals, Inc.,17, 2020. Overview We are a biopharmaceutical company where he led the chemistry team indedicated to the discovery, development and delivery of two clinical candidateslife-changing treatments that provide hope to underserved patient communities. Founded in 2011, we are delivering on our goal to transform the treatment and care of sickle cell disease, or SCD, a lifelong, devastating inherited blood disorder that is marked by red blood cell destruction and occluded blood flow and hypoxia, leading to anemia, stroke, multi-organ failure, severe pain crises, and shortened patient life span. Notably, 2019 was a pivotal year in our corporate history as we became a commercial-stage company with a marketed drug. In late November 2019, we received U.S. Food and Drug Administration, or FDA, accelerated approval for our first product, Oxbryta® (voxelotor) tablets for the treatment of Alzheimer’s disease. From July 1983SCD in adults and children 12 years of age and older. Oxbryta, an oral therapy taken once daily, is the firstFDA-approved treatment that directly inhibits sickle hemoglobin polymerization, an underlying cause of SCD. This FDA approval was three months ahead of the FDA’s Prescription Drug User Fee Act, or PDUFA, target action date of February 26, 2020, and we began to August 2006, Dr. Sham worked at Abbott Laboratories Inc., a global healthcare company, where hemake Oxbryta available to patients through our specialty pharmacy partner network in early December 2019. We are conducting and his team discoveredplan to conduct additional studies of Oxbryta, including our Phase 2a HOPE-KIDS 1 Study (an open-label, single- and advanced 10 clinical candidates spanning cardiovascular disease, HIV, oncologymultiple-dose Phase 2a study that is evaluating the safety, tolerability, pharmacokinetics and diabetes. His24-year tenure at Abbott Laboratories culminatedexploratory treatment effect of Oxbryta in his appointmentpediatric patients aged four to 17 years with SCD) and, as a distinguishedcondition of accelerated approval, our Phase 3 HOPE-KIDS 2 Study (a post-approval confirmatory study we initiated in December 2019 that is using transcranial Doppler, or TCD, flow velocity to seek to demonstrate a decrease in stroke risk in children two to 15 years of age). We also expect to conduct additional clinical studies of Oxbryta, including to seek to expand the potential approved product label into younger pediatric populations. Beyond Oxbryta, we are also engaged in other research fellowand development activities. For example, we are advancing our SCD pipeline with inclacumab, ap-selectin inhibitor in global pharmaceutical discovery. Dr. Shamdevelopment to address pain crises associated with the disease. In addition, our drug discovery team is working on new targets to develop the next generation of treatments for SCD. As part of those efforts, we regularly evaluate opportunities toco-inventorin-license, of Norvir®acquire or invest in new business, technology or assets or engage in related discussions with other business entities. In December 2019, we entered into a license and collaboration agreement, or the primary inventor of Kaletra®, Abbott Laboratories’ first and second-generation HIV protease inhibitors approved for the treatment of HIV. Dr. Sham has published more than 180 scientific articles in peer-reviewed journals and is a named inventor on 81 issued U.S. patents. Dr. Sham was named Hero of Chemistry by the American Chemical Society in 2003. Dr. Sham holds a Ph.D. in synthetic organic chemistry from the University of Hawaii and completed his post-doctoral training in the department of chemistry at Indiana University. PeterRadovich has served as our Senior Vice President, Operations, since September 2016, and was our Vice President, Program Leadership and Business Strategy from November 2014 to August 2016. Prior to that, in September 2006, he joined OnyxSyros Collaboration, with Syros Pharmaceuticals, Inc., a biopharmaceutical company (acquired by Amgen, Inc.),or Syros, to discover, develop and served as vice president,commercialize novel therapies for SCD and beta thalassemia.

Corporate Performance Highlights Our executive compensation program leadership from February 2014seeks to November 2014incentivize and as senior director from August 2011 to February 2014, during which time he led the company’s global, cross-functional product team responsible for the development and commercializationreward strong corporate performance. Highlights of Kyprolis®. Prior to joining Onyx, from 2004 to 2006, Mr. Radovich was at Chiron Corporation, a biopharmaceutical company (now Novartis AG) in product marketing supporting Proleukin®(interleukin-2) in multiple oncology indications. Mr. Radovich holds a B.A. in biology and chemistry from Texas Christian University and an M.B.A. from Washington University in St. Louis. COMPENSATION OF EXECUTIVE OFFICERS

Summary Compensation Table

The following table presents information regarding the total compensation earned by each individual who served as our chief executive officer at any time during the fiscal year ended December 31, 2016, our two other most highly compensated executive officers who were serving as executive officers as of December 31, 2016 and one individual who would have been included as one of the most highly compensated executive officers except that she was no longer serving as an executive officer at the end of 2016. We refer to these officers in this Proxy Statement as our named executive officers. The following table also sets2019 corporate performance are set forth information regarding total compensation awarded to, earned by and paid to each of these named executive officers during the fiscal year ending December 31, 2015, to the extent they were named executive officers in 2015.below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | Name and Principal Position | | Year | | | Salary

($) | | | Stock Awards

($) | | | Option

Awards

($)(1) | | | Non-Equity

Incentive Plan

Compensation

($)(2) | | | All Other

Compensation

($)(3) | | | Total

($) | | | | | | | | | | Ted W. Love, M.D. | | | 2016 | | | | 479,375 | | | | 507,838 | (4) | | | — | | | | 230,000 | | | | 2,500 | | | | 1,219,713 | | | | | | | | | | President, Chief Executive Officer and Director | | | 2015 | | | | 437,500 | | | | 1,022,424 | | | | — | | | | 76,500 | | | | 750 | | | | 1,537,174 | | | | | | | | | | Jeffrey Farrow(5) | | | 2016 | | | | 298,718 | | | | — | | | | 1,613,816 | | | | 115,000 | | | | 2,500 | | | | 2,030,034 | | | | | | | | | | Chief Financial Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Tricia Suvari(6) | | | 2016 | | | | 81,657 | | | | — | | | | 1,156,660 | | | | — | | | | 500 | | | | 1,238,817 | | | | | | | | | | Chief Legal Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Eleanor L. Ramos, M.D.(7) | | | 2016 | | | | 350,949 | | | | — | | | | 1,113,389 | (8) | | | — | | | | 199,024 | (9) | | | 1,663,362 | | | | | | | | | | Former Chief Medical Officer | | | 2015 | | | | 358,333 | | | | — | | | | 175,112 | | | | 47,500 | | | | 750 | | | | 581,695 | |

(1) | • | | Regulatory and Commercial |

| ✓ | | In accordanceJune 2019, we announced final agreement with SEC rules, these columns reflect the aggregate grantFDA on the design of the post-approval confirmatory study of Oxbryta, our Phase 3 HOPE-KIDS 2 Study. |

| ✓ | | In September 2019, we announced that the FDA accepted for filing our New Drug Application, or NDA, seeking accelerated approval for Oxbryta and that the FDA granted Priority Review for the NDA, thus providing for asix-month review period and a PDUFA target action date fair value of restricted stockFebruary 26, 2020. |

| ✓ | | In the third quarter of 2019, we hired approximately 65 Sickle Cell Therapeutic Specialists, bringing our field team to approximately 75 members, on an accelerated hiring plan that met a product approval in November 2019, well in advance of the FDA’s PDUFA target action date. |

| ✓ | | In late November 2019, three months ahead of the FDA’s PDUFA target action date, the FDA granted accelerated approval for Oxbryta for the treatment of SCD in adults and option awards granted during 2016children 12 years of age and 2015older. |

| ✓ | | Upon the approval of Oxbryta, we launched GBT Source SolutionsTM, a comprehensive program for patients who are prescribed Oxbryta, their families and healthcare providers, which provides a wide range of practical, educational and financial support customized to each patient’s needs. |

| ✓ | | In early December 2019, Oxbryta was first made available in accordancethe United States through our specialty pharmacy partner network. |

| ✓ | | We completed the following financing transactions, ending 2019 with FASB ASC Topic 718. Pursuanta cash reserve that exceeded our 2019year-end cash goal: |

In June 2019, we raised approximately $197.8 million in net proceeds from an underwritten public offering. In December 2019, we entered into a $150 million loan agreement with funds managed by Pharmakon Advisors LP, a leading global life sciences investment firm, and drew down the first tranche of $75 million with the close of the transaction. | ✓ | | In December 2019, we entered into the Syros Collaboration to FASB ASC Topic 718, the amounts shown exclude the impactdiscover, develop and commercialize novel therapies for SCD and beta thalassemia. |

| ✓ | | In 2019, we appointed a chief scientific officer and a chief human resources officer to our senior management team. |

| Overview of estimated forfeituresExecutive Compensation Program |

Executive Compensation Philosophy Our executive compensation program is guided by our overarching philosophy of paying for demonstrable performance. Consistent with this philosophy, we have designed our executive compensation program to achieve the following primary goals: attract, motivate and retaintop-performing senior executives; establish compensation opportunities that are competitive and reward performance; and align the interests of our senior executives with the interests of our stockholders to drive the creation of sustainable long-term value. Executive Compensation Program Design Our executive compensation program is designed to be reasonable and competitive, and balance our goal of attracting, motivating, rewarding and retainingtop-performing senior executives with our goal of aligning their interests with those of our stockholders. The Compensation Committee annually evaluates our executive compensation program to ensure that it is consistent with our short- and long-term goals and the dynamic nature of our business. Our executive compensation program consists of a mix of compensation elements that balance achievement of our short-term goals with our long-term performance. We provide short-term incentive compensation opportunities in the form of annual cash bonuses, which focus on our achievement of annual corporate goals. We also provide long-term incentive compensation opportunities in the form of equity awards, including both stock options and restricted stock units, or RSUs, which focus on our long-term performance. We believe that stock options provide a strong reward for growth in the market price of our common stock because their entire value depends on future stock price appreciation. We believe RSUs also reward growth in the market price of our common stock because they derive additional value from future stock price appreciation, and they are less dilutive to our stockholders because they require fewer shares than stock options. In addition, we believe that the multi-year vesting requirements applicable to both stock options and RSUs encourage retention because our senior executives are incentivized to remain employed through the vesting period. Our executive compensation program is also designed to incorporate sound practices for compensation governance. Below we summarize such practices. What We Do: | ✓ | | Maintain an Independent Compensation Committee. The Compensation Committee consists solely of independent directors. |

| ✓ | | Retain an Independent Compensation Advisor. The Compensation Committee engages its own compensation advisor to provide information and analysis related to service-based vesting conditions. For additional informationannual executive compensation decisions, including the 2019 executive compensation decisions, and other advice on executive compensation independent of management. |

| ✓ | | Review Executive Compensation Annually. The Compensation Committee annually reviews our compensation strategy, including a review and determination of our compensation peer group used for comparative purposes. |

| ✓ | | EmphasizeAt-Risk Compensation. Our executive compensation program is designed so that a significant portion of our executive officers’ compensation is “at risk” based on our corporate performance, as well as equity-based, to align the interests of our executive officers and stockholders. |

| ✓ | | Use aPay-for-Performance Philosophy. The majority of our executive officers’ compensation is directly linked to corporate performance and includes a significant long-term equity component, thereby making a substantial portion of each executive officer’s total compensation dependent upon our stock price and/or total stockholder return. |

| ✓ | | Align Board and Executive with Shareholder Interests. Our executive officers (andnon-executive members of our senior management team), as well as the members of our board of directors, are subject to stock ownership guidelines requiring each of them to maintain ownership of a predetermined amount of company stock. |

| ✓ | | Use Double TriggerChange-in-Control Protection.Change-in-control payments and benefits to our executive officers occur only upon a qualifying termination of employment in connection with a change in control, not merely upon a change in control. |

What We Don’t Do: | ✗ | | No Executive Retirement Plans. We do not offer pension arrangements or retirement plans or arrangements to our executive officers that are different from or in addition to those offered to our other employees. |

| ✗ | | Limited Perquisites. We do not view perquisites as a significant component of our executive compensation program. Accordingly, we do not provide significant perquisites to our executive officers, including our NEOs, except for limited travel stipends or limited housing and travel reimbursements for recruitment and retention purposes. |

| ✗ | | No Special Health and Welfare Benefits. Our executive officers participate in our health and welfare benefits programs on the valuation assumptions underlyingsame basis as our other employees. |

| ✗ | | No Post-Employment Tax Payment Reimbursement. We do not provide any tax reimbursement payments (including“gross-ups”) on anychange-in-control or severance payments or benefits. |

| ✗ | | No Hedging or Pledging Our Equity Securities. We prohibit our executive officers, the valuemembers of restricted stock and options, see Part II, Item 8 “Financial Statements and Supplementary Data” of our 2016 Annual Report onForm 10-K in the Notes to Consolidated Financial Statements, Note 7, “Stock-based awards”. |

(2) | The amounts reported for 2016 reflect the cash incentive compensation determined by our Compensation Committee (for the Named Executive Officers other than the CEO), and by our Board of Directors upon recommendationand certain other employees from hedging or pledging our securities. |

| ✗ | | No Stock OptionRe-Pricing. Our equity plans do not permit stock options to be repriced to a lower exercise or strike price without the approval of our Compensation Committee (for our CEO), based on achievement of certain research and development, clinical, financial and operational metrics related to our 2016 corporate objectives, as specified by our Board of Directors. |

(3) | The amounts reported in this column consist of employer matching contributions received by Dr. Love, Mr. Farrow and Ms. Suvari in connection with the Company’s 401(k) plan benefits, described in greater detail below, and certain termination benefits paid to Dr. Ramos, as described in greater detail below. |

(4) | Includes $507,838 representing the expense recognized by the Company resulting from the modification of 24,821 shares of performance-based restricted stock awards awarded to and purchased by Dr. Love. The performance goals associated with these restricted stock awards were modified and subsequently achieved during 2016. |

(5) | Mr. Farrow joined us in April 2016, and the amount reported in the salary column reflects his partial year of service with us. |

stockholders.(6) | Ms. Suvari joined us in October 2016, and the amount reported in the salary column reflects her partial year of service with us. In addition, Ms. Suvari was paid aone-time cash bonus on January 31, 2017, which we deemed to be compensation earned in 2017 and is not included in the table above. |

(7) | Dr. Ramos’ employment with the Company ended effective October 24, 2016. We entered into a Termination Letter Agreement with Dr. Ramos, effective November 7, 2016, which provided for the payment of cash severance, the continuation of certain benefits, and accelerated vesting for certain of Dr. Ramos’ outstanding stock options. See “Termination Agreement with Eleanor L. Ramos, M.D.”, below, for further details. |

(8) | Includes (a) $165,755 representing the expense recognized by the Company resulting from the modification of 9,286 performance-based stock options awarded to Dr. Ramos and (b) $947,634 resulting from the acceleration of options to purchase an aggregate of 54,999 shares pursuant to the Termination Letter Agreement. |

(9) | Represents cash severance and benefits continuation paid or payable pursuant to the Termination Letter Agreement. |

BaseSalaries.

| “Say-on-Pay” Vote on Executive Compensation |

At our 2019 Annual Meeting of Stockholders, we held anon-binding, advisory vote on the compensation of our NEOs (a“Say-on-Pay” vote) and approximately 97% of the votes cast approved our executive compensation program for 2018. Our Board of Directors and Compensation Committee consider the result of theSay-on-Pay vote in determining the compensation of our executive officers. Based on the strong level of support for our executive compensation program demonstrated by the result of last year’sSay-on-Pay vote, among other factors, the Board of Directors and the Compensation Committee determined not to implement significant changes to our executive compensation program for 2019. The Board of Directors and the Compensation Committee will continue to consider the result of theSay-on-Pay vote, as well as feedback received throughout the year, when making compensation decisions for our executive officers in the future because we value the opinions of our stockholders. In addition, consistent with the recommendation of our Board of Directors and the preference of our stockholders as reflected in thenon-binding, advisory vote on the frequency of futureSay-on-Pay votes held at our 2018 Annual Meeting of Stockholders, we intend to hold an annualSay-on-Pay vote. Our nextSay-on-Pay vote will be held at the Annual Meeting. | Governance of Executive Compensation Program |

Role of the Compensation Committee and the Board of Directors The Compensation Committee discharges many of the responsibilities of our Board of Directors relating to the compensation of our executive officers, including our NEOs. The Compensation Committee oversees and evaluates our compensation and benefits policies generally, and the compensation plans, policies and practices applicable to our CEO and other executive officers. As described below, the Compensation Committee retains a compensation consultant to provide support in its review and assessment of our executive compensation program. In addition, during 2019, pursuant to our Amended and Restated Equity Award Grant Policy, or Equity Award Grant Policy, the Compensation Committee delegated to our CEO the authority to approve grants of equity awards, subject to certain parameters, under the 2015 Plan and any other equity compensation plan that the Compensation Committee or the Board may determine to be subject to the policy, excluding our 2017 Inducement Equity Plan, or 2017 Inducement Plan. In January 2020, our Compensation Committee further amended and restated the Equity Award Grant Policy to provide for the delegation of such authority to a committee comprised of our CEO and at least one other executive officer, and such committee is currently comprised of our CEO and our Chief Human Resources Officer. See “Other Compensation Policies and Practices—Equity Award Grant Policy.” At the beginning of the year, the Compensation Committee reviews and approves the primary elements of compensation—base salary increases, annual cash bonuses, and annual equity awards—for our CEO, and for all individuals at or above the level of Vice President who report directly to our CEO, which includes our other NEOs. In addition, the Compensation Committee may deem it advisable to review and approve subsequent compensation opportunities for our CEO and such other individuals. Compensation-Setting Factors When reviewing and approving the amount of each compensation element and the target total compensation opportunity for our executive officers, the Compensation Committee considers the following factors: our performance against the annual corporate goals established by the Compensation Committee in consultation with management; each executive officer’s skills, experience and qualifications relative to other similarly-situated executives at the companies in our compensation peer group; the scope of each executive officer’s role compared to other similarly-situated executives at the companies in our compensation peer group; the performance of each individual executive officer, based on an assessment of his or her contributions to our overall performance, ability to lead his or her department and work as part of a team, all of which reflect our core values; compensation parity among our executive officers; our financial performance relative to our peers; the compensation practices of our compensation peer group and the positioning of each executive officer’s compensation in a ranking of peer company compensation levels; and the recommendations provided by our CEO with respect to the compensation of our other executive officers. These factors provide the framework for compensation decisions for each of our executive officers, including our NEOs. The Compensation Committee does not assign relative weights or rankings to these factors, and does not consider any single factor as determinative in the compensation of our executive officers. Rather, the Compensation Committee relies on its own knowledge and judgment in assessing these factors and making compensation decisions. Role of Management In discharging its responsibilities, the Compensation Committee works with management, including our CEO. Our management assists the Compensation Committee by providing information on corporate and individual performance, market compensation data and management’s perspective on compensation matters. In addition, at the beginning of each year, our CEO reviews the performance of our other executive officers, including our other NEOs, based on our achievement of our annual corporate goals and each executive officer’s achievement of his or her departmental and individual goals established for the prior year and his or her overall performance during that year. The Compensation Committee solicits and reviews our CEO’s recommendations for base salary increases, annual cash bonuses, annual equity awards and any other compensation opportunities for our other executive officers, including our other NEOs, and considers our CEO’s recommendations in determining such compensation. Role of Compensation Consultant The Compensation Committee engages an external compensation consultant to assist it by providing information, analysis and other advice relating to our executive compensation program. For 2019, the Compensation Committee engaged Compensia, Inc., a national compensation consulting firm, or Compensia, as its compensation consultant to advise on executive compensation matters, including: review and analysis of the compensation for our executive officers, including our NEOs; review and input on the Compensation Discussion and Analysis section of our proxy statement for our 2019 Annual Meeting of Stockholders; research, development and review of our compensation peer group; and support on other compensation matters as requested throughout the year. Compensia reports directly to the Compensation Committee and to the chair of the Compensation Committee. Compensia also coordinates with our management for data collection and job matching for our executive officers. Compensia did not provide any other services to us in 2019. The Compensation Committee has evaluated Compensia’s independence pursuant to the listing standards of the relevant NASDAQ and SEC rules and has determined that no conflict of interest has arisen as a result of the work performed by Compensia. Role of Market Data For purposes of comparing our executive compensation against the competitive market, the Compensation Committee reviews and considers the compensation levels and practices of a group of peer companies. This compensation peer group consists of public biotechnology companies that are similar to us in terms of market capitalization, stage of development, geographical location and number of employees. The Compensation Committee reviews our compensation peer group at least annually and makes adjustments to our peer group if necessary, taking into account changes in both our business and our peer companies’ businesses. In November 2018, the Compensation Committee, with the assistance of Compensia, reviewed our compensation peer group to determine our peer group for the remainder of 2018 and for 2019. The Compensation Committee considered the increases in our market capitalization and our headcount relative to prior periods, and our potential commercial launch, as reflected in the following criteria: publicly-traded companies headquartered in the United States; companies in the biotechnology sector; similar market capitalization—within a range of approximately 0.33x to approximately 3.0x our then-current market capitalization of approximately $2.35 billion (approximately $775 million to approximately $7 billion); the stage of development of each company’s lead candidate (with a preference for companies with Phase 2 or Phase 3 clinical development programs,pre-commercial companies and commercial companies); companies developing either orphan drugs or with a rare disease focus; and similar headcount—within a range of approximately 0.5x to approximately 2.0x our then-current headcount of 148 employees (approximately 75 to 300 employees). Based on a review of the analysis prepared by Compensia, the Compensation Committee approved the updated compensation peer group below for the remainder of 2018 and for 2019. This peer group was used in evaluating the 2019 annual base salary, target annual bonus opportunities and equity awards for our NEOs. | | | | | 2018—2019 Compensation Peer Group | Acceleron Pharma Agios Pharmaceuticals Aimmune Therapeutics Alder BioPharmaceuticals AnaptysBio Arena Pharmaceuticals Atara Biotherapeutics | | bluebird bio Blueprint Medicines Coherus Biosciences Epizyme FibroGen Insmed Loxo Oncology | | Portola Pharmaceuticals Regenxbio Sage Therapeutics Spark Therapeutics Ultragenyx Pharmaceuticals Versartis Xencor |

In July 2019, the Compensation Committee, with the assistance of Compensia, reviewed our compensation peer group to determine our peer group for the remainder of 2019 and for 2020. The Compensation Committee considered our potential estimated revenues in 2020, the increase in our market capitalization and headcount and the near-commercial stage of our lead product candidate, as reflected in the following criteria: publicly-traded companies headquartered in the United States; companies in the biotechnology and pharmaceutical sector; similar estimated revenues in 2020—up to 4.0x our projected 2020 revenue; similar market capitalization—within a range of approximately 0.33x to approximately 3.0x our then-current market capitalization of approximately $3.3 billion (approximately $1.1 billion to approximately $9.9 billion); the stage of development of each company’s lead candidate (with a preference for companies with candidates pending approval, approved or commercialized, and excluding companies whose lead candidates were in Phase 2 or Phase 3 development); companies developing either orphan drugs or with a rare disease focus; and similar headcount—within a range of approximately 0.33x to approximately 3.0x our then-current headcount of 171 employees (approximately 50 to 500 employees). Based on a review of the analysis prepared by Compensia, the Compensation Committee approved the updated compensation peer group below for the remainder of 2019 and for 2020. | | | | | 2019—2020 Compensation Peer Group | ACADIA Pharmaceuticals Acceleron Pharma Agios Pharmaceuticals Aimmune Therapeutics Alnylam Pharmaceuticals Amicus Therapeutics bluebird bio | | Coherus Biosciences Epizyme FibroGen Insmed Intercept Pharmaceuticals Nektar Therapeutics | | Portola Pharmaceuticals Regenxbio Sage Therapeutics Sarepta Therapeutics Spark Therapeutics Ultragenyx Pharmaceuticals |

The Compensation Committee uses market data—from our compensation peer group and from the Radford Global Life Sciences Compensation survey—as one factor in evaluating whether the compensation for our executive officers is competitive in the market. The Compensation Committee also relies on its own knowledge and judgment in evaluating market data and making compensation decisions. | Primary Elements of Executive Compensation Program |

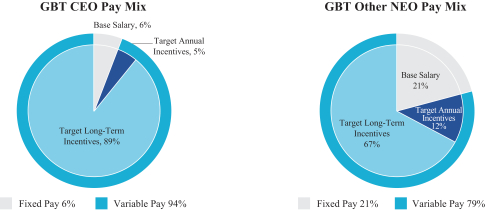

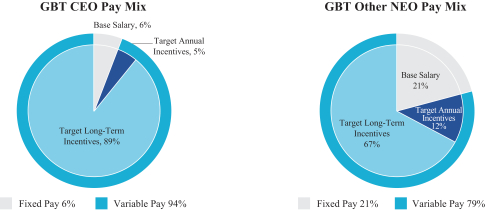

The primary elements of our executive compensation program are: short-term incentive compensation in the form of annual cash bonuses; and long-term incentive compensation in the form of annual equity awards. We do not have a specific policy regarding the percentage allocation between short- and long-term, or fixed and variable, compensation elements. The balance between these components may change from year to year based on corporate strategy, company performance, market forces and company objectives, among other considerations, but consistent with our philosophy of paying for demonstrable performance, our executive compensation program emphasizes variable pay over fixed pay. For example, in 2019, our CEO and other NEOs had the following target pay mix:

Our executive officers, including our NEOs, are also eligible to participate in our standard employee benefit plans, such as our health and welfare benefits plans, our 2015 Employee Stock Purchase Plan, or ESPP, and our 401(k) Plan on the same basis as our other employees. In addition, as described below, our executive officers, including our NEOs, are entitled to certainchange-in-control severance payments and benefits and certain termination payments and benefits not in connection with a change in control pursuant to our Amended and Restated Severance and Change in Control Policy. Base Salary We pay base salaries to our executive officers, including our NEOs, as the fixed portion of their compensation to provide them with a reasonable degree of financial certainty, and to attract and retaintop-performing individuals. At the time of hire, base salaries are determined for our executive officers, including our NEOs, based on the factors described in “Governance of Executive Compensation Program—Compensation-Setting Factors” above. Typically, at the beginning of each year, the Compensation Committee reviews base salaries for our executive officers, including our NEOs, based on such factors to determine if an increase is appropriate. In addition, base salaries may be adjusted in the event of a promotion or significant change in responsibilities. 2019 Annual Base Salary In January 2019, the Compensation Committee reviewed the base salaries of our executive officers, including our namedNEOs. The Compensation Committee considered the factors described in “Governance of Executive Compensation Program—Compensation-Setting Factors” above. In particular, the Compensation Committee considered better alignment with comparable positions from our compensation peer group in determining the larger base salary increases for Dr. Love and Dr. Lehrer-Graiwer. Effective in February 2019, the Compensation Committee approved the base salaries of our NEOs, except Dr. Cathers, below. | | | | | | | | | | | | | NEO | | 2018 Annual

Base Salary | | | 2019 Annual

Base Salary | | | Percentage

Increase | | | | | | Dr. Love | | $ | 575,000 | | | $ | 600,000 | | | | 4.3 | % | | | | | Mr. Farrow | | $ | 427,500 | | | $ | 442,500 | | | | 3.5 | % | | | | | Mr. Johnson | | $ | 440,000 | | | $ | 455,000 | | | | 3.4 | % | | | | | Dr. Lehrer-Graiwer | | $ | 400,000 | | | $ | 425,000 | (1) | | | 6.3 | % |

| (1) | In connection with his promotion to Chief Medical Officer and additional responsibilities in October 2019, Dr. Lehrer-Graiwer’s 2019 annual base salary was increased from $425,000 to $460,000, effective October 1, 2019. |

In February 2019, we hired Dr. Cathers as our Chief Scientific Officer. The Compensation Committee considered the factors described in “Governance of Executive Compensation Program-Compensation-Setting Factors” above, particularly market data from our compensation peer group for comparable positions, in approving Dr. Cathers’ annual base salary of $375,000. The actual base salaries paid to our NEOs in 2019 are set forth in the “Summary Compensation Table” below. Short-Term Incentive Compensation Annual Cash Bonuses We provide short-term incentive compensation opportunities to our executive officers, from time to time and makes adjustments (or,including our NEOs, in the caseform of annual cash bonuses to drive our Chief Executive Officer, may recommend adjustmentsshort-term success. Our annual cash bonuses for approval by2019 were tied to the Boardachievement of Directors) as it determinesannual corporate and individual performance goals pursuant to be reasonable and necessary to reflect the scope of the executive officer’s performance, contributions, responsibilities, experience, prior salary level, position (in the case of a promotion) and market conditions, including base salary amounts relative to similarly situated executive officers at peer group companies. CashIncentiveCompensation. In January 2016, the Board of Directors adopted the Company’sour Senior Executive Cash Incentive Bonus Plan, (the “Incentive Plan”), which applies to certain key executives (the “Covered Executives”), that are recommended byor Cash Incentive Plan.

Corporate and Individual Performance Goals At the beginning of each year, the Compensation Committee, after reviewing management’s proposal, establishes the annual corporate performance goals that it believes will be the most significant drivers of our short- and selected bylong-term success. The corporate performance goals include target achievement dates based on calendar quarters. Each corporate performance goal has a percentage weighting, and may include an additional percentage weighting for overachievement, based on the BoardCompensation Committee’s assessment of Directors.the goal’s relative significance. In addition, at the beginning of each year, our CEO, in consultation with each of the other executive officers, establishes individual performance goals for each of the other executive officers, including our other NEOs. The Incentive Plan providesindividual performance goals are generally designed to align the goals of our executive officers, including our NEOs, and his or her department with the corporate goals. The Compensation Committee weights annual cash bonuses for each of our executive officers, including our NEOs, between the achievement of corporate and individual goals. This weighting is the same for each of our executive officers, including our NEOs, who are at the same level. Our CEO does not have individual goals. Rather, his annual cash bonus paymentsis based upon100% on achievement of our corporate goals in recognition of his overall responsibility for our corporate performance. At the attainmentbeginning of the year after the corporate performance objectivesgoals are established, by the Compensation Committee, and related to operational and financial metrics with respect to the Company or any of its subsidiaries (the “Corporate Performance Goals”), which may includeafter reviewing management’s self-assessment, evaluates our achievement of specified researchthe prior year’s corporate performance goals, and development, publication, clinical and/or regulatory milestones, total shareholder return, earnings before interest, taxes, depreciation and amortization, net income (loss) (either before or after interest, taxes, depreciation, stock compensation expense, restructuring charges and/or amortization), changesour overall success in the market priceprior year, and determines our total percentage achievement level. Our CEO evaluates the other executive officers’, including the other NEOs’, achievement of their prior year’s individual performance goals, and makes recommendations for total percentage achievement level. The Compensation Committee considers our CEO’s recommendations, and independently reviews and approves the total percentage achievement level for each of the Company’s common stock, economic value-added, funds from operations or similar measure, sales or revenue, acquisitions or strategic transactions, operating income (loss), cash flow (including, but not limitedother executive officers, including our other NEOs. Target Annual Bonuses The target annual bonus is determined for each of our executive officers, including our NEOs, at the time of hire as well as at the beginning of each year, by reference to operating cash flow and free cash flow), return on capital, assets, equity, or investment, return on sales, gross or net profit levels, productivity, expense, margins, operating efficiency, customer satisfaction, working capital, earnings (loss) per share of the Company’s common stock; bookings, new bookings or renewals; sales or market shares; number of customers, number of new customers or customer references; operating income and/or net annual recurring revenue. Any bonuses paid under thethen applicable Cash Incentive Plan, will be based upon objectively determinable bonus formulas that tie suchwhich sets out the target annual bonuses to one or more performance targets relating tofor employees by position level. In approving the Corporate Performance Goals. The bonus formulas will be adopted in each performance period byCash Incentive Plan, the Compensation Committee considers the factors described in “Governance of Executive Compensation Program—Compensation-Setting Factors” above, with an emphasis on market data from our compensation peer group for comparable positions. Target annual bonuses are the same for executive officers, including our NEOs, who are at the same level, and communicatedrepresent a specific percentage of annual base salary. Annual Cash Bonus Formula The Compensation Committee uses the following formula to calculate annual cash bonuses for each Covered Executive. No bonuses will be paid under the Incentive Plan unlessof our executive officers, including our NEOs: | | | | | | | | | | | | | | | | | | | | | | | | | | ( | | Total % achievement of annual corporate performance goals | | x | | % weighting of annual corporate performance goals | | + | | Total % achievement of annual individual performance goals | | x | | % weighting of annual individual performance goals | | ) | | x | | Target Annual Bonus % | | x | | Annual Base Salary |

2019 Corporate Performance Goals In January 2019, our Board of Directors approved our 2019 annual corporate performance goals and untilweightings as set forth below. | | | | | Category | | Corporate Goal | | Weighting | Oxbryta | | • NDA accepted by FDA • Achieve certain data publication goals • Achieve certain market and commercial launch goals | | 45% (subject to increase to 67.5% upon achievement of a specified stretch goal) 10% (subject to increase to 15% upon achievement of a specified stretch goal) 20% | | | | Inclacumab | | • Achieve certain research goal with respect to inclacumab | | 10% | | | | Pipeline | | • Nominate one candidate for development and achieve certain business development goals | | 10% | | | | Corporate | | • Complete the year with a cash reserve of at least a certain minimum | | 5% |

2019 Target Annual Bonus In January 2019, the Compensation Committee makes a determinationreviewed the target annual bonuses of our executive officers, including our NEOs. The Compensation Committee considered the factors described in “Governance of Executive Compensation Program—Compensation-Setting Factors” above, particularly market data from the companies in our compensation peer group, and approved the 2019 target annual bonuses of our NEOs, except Dr. Cathers, below. | | | | | | | | | NEO | | 2018 Target Annual Bonus | | | 2019 Target Annual Bonus | | Dr. Love | | | 60 | % | | | 60 | % | Mr. Farrow | | | 40 | % | | | 40 | % | Mr. Johnson | | | 40 | % | | | 40 | % | Dr. Lehrer-Graiwer | | | 35 | % | | | 40 | %(1) |

| (1) | In connection with his promotion to Chief Medical Officer and additional responsibilities in October 2019, Dr. Lehrer-Graiwer’s 2019 target annual bonus was increased from 35% to 40% of his annual base salary, effective October 1, 2019. |

In February 2019, we hired Dr. Cathers as our Chief Scientific Officer. The Compensation Committee considered the factors described in “Governance of Executive Compensation Program—Compensation-Setting Factors” above, particularly market data from our compensation peer group for comparable positions and alignment with respect toour other executive officers at the attainmentsame level, in approving Dr. Cathers’ 2019 target annual bonus of 40%. 2019 Annual Cash Bonuses In January 2020, the Compensation Committee evaluated our achievement of the 2019 corporate performance objectives. Notwithstandinggoals. The Compensation Committee considered whether we had achieved each goal, the foregoing,weighting established for each goal, including the weighting for overachievement, management’s self-assessment, and our overall corporate performance in 2019. Based on these considerations, the Compensation Committee approved a 150% achievement level of the 2019 corporate performance goals due in part to certain extraordinary achievements, including: (i) our receipt of approval by the FDA for Oxbryta three months in advance of its PDUFA target action date, (ii) the successful acceleration of our sales force hiring and commercial launch readiness, (iii) our completion of our strategic Syros Collaboration in furtherance of our pipeline and (iv) our success in exceeding our 2019year-end cash goal with our equity and debt financings. The Compensation Committee also reviewed the 2019 individual performance of each of our executive officers, other than our CEO, based on an evaluation conducted by our CEO of their performance against their 2019 individual performance goals. The Compensation Committee approved an achievement level of 100% of the 2019 individual performance goals for each of our NEOs. The table below sets forth the target annual cash bonuses, the relative weighting of corporate and individual performance, the actual achievement level for corporate and individual performance and the 2019 annual cash bonuses earned by our NEOs. | | | | | | | | | | | | | | | | | | | | | | | | | NEO | | 2019 Annual

Base Salary

($) | | | Target Annual

Cash Bonus

(% of annual

base salary) | | | Weighting

(corporate/

individual

performance)

(%) | | | Corporate

Performance

(%) | | | Individual

Performance

(%) | | | Annual Cash

Bonus

($) | | Dr. Love | | $ | 600,000 | | | | 60 | % | | | 100%/0 | | | | 150 | % | | | N/A | | | $ | 540,000 | | Mr. Farrow(1) | | $ | 442,500 | | | | 40 | % | | | 75%/25% | | | | 150 | % | | | 100 | % | | $ | 244,000 | | Dr. Cathers (1)(2) | | $ | 375,000 | | | | 40 | % | | | 75%/25% | | | | 150 | % | | | 100 | % | | $ | 172,000 | | Mr. Johnson(1) | | $ | 455,000 | | | | 40 | % | | | 75%/25% | | | | 150 | % | | | 100 | % | | $ | 250,000 | | Dr. Lehrer-Graiwer | | $ | 460,000 | | | | 40 | % | | | 75%/25% | | | | 150 | % | | | 100 | % | | $ | 253,000 | |

| (1) | Annual cash bonus was immaterially adjusted for rounding. |

| (2) | Dr. Cathers’ employment commencement date was February 25, 2019, and his 2019 annual cash bonus was prorated based on his employment with us for approximately ten months of 2019. |

The annual cash bonuses earned by each of our NEOs for 2019 are set forth in the “Summary Compensation Table” below. Long-Term Incentive Compensation We view long-term incentive compensation in the form of equity awards as an important element of our executive compensation program. The value of equity awards is directly related to stock price appreciation over time, which incentivizes our executive officers to achieve long-term corporate goals and create long-term value for our stockholders. Equity awards also help us attract and retaintop-performing executive officers in a competitive market. At the time of hire, equity awards are granted to our executive officers, including our NEOs, based on the factors described in “Governance of Executive Compensation Program—Compensation-Setting Factors” above. Typically, at the beginning of each year, the Compensation Committee reviews the equity awards for our executive officers, including our NEOs, and determines the size and relative weighting of the annual equity awards it deems reasonable and appropriate based on such factors. The size and relative weighting is the same for each of our executive officers, including our NEOs, who are at the same level. In addition, the Compensation Committee may deem it advisable to grant subsequent equity awards to our executive officers, including our NEOs, and may adjust bonuses payable undertheir equity awards in the Incentive Plan based on achievementevent of individual performance goalsa promotion or pay bonuses (including, without limitation, discretionary bonuses) to Covered Executives under the Incentive Plan based on individual performance goals and/or upon such other terms and conditions assignificant change in responsibilities. 2019 Equity Awards 2019 Annual Equity Awards In January 2019, the Compensation Committee mayconsidered the factors described in its discretion determine.“Governance of Executive Compensation Program—Compensation-Setting Factors” above, particularly market data from the companies in our compensation peer group, and approved the 2019 annual equity awards for our NEOs, except Dr. Cathers, below. EquityIncentiveCompensation. Historically, we have generally granted

| | | | | | | | | NEO | | Stock Options

(Number of Shares) | | | Time-Based RSUs

(Number of Shares) | | Dr. Love | | | 145,000 | | | | 90,000 | | Mr. Farrow | | | 40,000 | | | | 25,000 | | Mr. Johnson | | | 40,000 | | | | 25,000 | | Dr. Lehrer-Graiwer | | | 35,000 | | | | 23,500 | |

The stock options vest, and become exercisable, over a four-year period, with 1/16th of the underlying shares vesting on a quarterly basis (every three months) after the vesting commencement date of February 1, 2019, so that all of the underlying shares will be vested on the date four years after the vesting commencement date, so long as the NEO remains an employee or other service provider (including a consultant) of the Company on such vesting dates. The time-based RSUs vest over a four-year period, with 1/8th of the underlying shares vesting on a semi-annual basis (every six months) after the vesting commencement date of February 1, 2019, so that all of the underlying shares will be vested on the date four years after the vesting commencement date, so long as the NEO remains an employee or other service provider (including a consultant) of the Company on such vesting dates. 2019 Equity Awards for New Executive Officers In February 2019, we hired Dr. Cathers as our Chief Scientific Officer. The Compensation Committee considered the factors described in “Governance of Executive Compensation Program—Compensation-Setting Factors” above, particularly market data from our compensation peer group for comparable positions, in approving Dr. Cathers’ new hire equity awards as follows: a stock option to purchase 45,000 shares of our common stock and 30,000 time-based RSUs. The stock options vest, and become exercisable, over a four-year period, with 1/4th of the underlying shares vesting on the first anniversary of the vesting commencement date of February 25, 2019, and thereafter, 1/12th of the remaining underlying shares vest on a quarterly basis so that all of the underlying shares will be vested on the date four years after the vesting commencement date, so long as Dr. Cathers remains an employee or other service provider (including a consultant) of the Company on such vesting dates. The time-based RSUs vest over a four-year period, with 1/4th of the underlying shares vesting on the first anniversary of the vesting commencement date of March 1, 2019, and thereafter 1/6th of the remaining underlying shares vest on a semi-annual basis (every six months) so that all of the underlying shares will be vested on the date four years after the vesting commencement date, so long as Dr. Cathers remains an employee or other service provider (including a consultant) of the Company on such vesting dates. In connection with his appointment as our Chief Medical Officer in October 2019, the Compensation Committee additionally granted Dr. Lehrer-Graiwer an option to purchase 5,000 shares of our common stock and time-based RSUs that may vest and be settled for 1,500 shares of our common stock. The option vests, and becomes exercisable, over a four-year period, with 1/16th of the underlying shares vesting on a quarterly basis (every three months) after the vesting commencement date of October 1, 2019, so that all of the underlying shares will be vested on the date four years after the vesting commencement date, so long as Dr. Lehrer-Graiwer remains an employee or other service provider (including a consultant) of the Company on such vesting dates. The time-based RSUs vest over a four-year period, with 1/8th of the underlying shares vesting on a semi-annual basis (every six months) after the vesting commencement date of October 1, 2019, so that all of the underlying shares will be vested on the date four years after the vesting commencement date, so long as Dr. Lehrer-Graiwer remains an employee or other service provider (including a consultant) of the Company on such vesting dates. As noted above, Dr. Lehrer-Graiwer resigned from the company effective April 17, 2020, and did not remain in our service (including as a consultant) past that date. The equity awards granted to our employees,NEOs in 2019 are set forth in the “Summary Compensation Table” and the “Grants of Plan-Based Awards for Fiscal Year 2019” table below. Health and Welfare Benefits Our executive officers, including our namedNEOs, are eligible to participate in the same employee benefit plans that are generally available to all of our employees, subject to the satisfaction of certain eligibility requirements, such as medical, dental, and life and disability insurance plans. We pay, on behalf of our employees, all or a portion of the premiums for health, life and disability insurance. 2015 Employee Stock Purchase Plan Our executive officers, including our NEOs, are eligible to participate in connectionour ESPP on the same basis as our other full-time employees. The ESPP permits eligible employees to set aside a portion of their compensation during offering periods that are generally two years long, with their initial employment with us. Beginning in 2017, our practice ispurchase periods generally every six months during each offering period, and use such contributions to grant a combination of stock options and restricted stock units to our employees, including executive officers, in connection with their initial employment with us. Prior to our initial public offering in August 2015, we granted to employees, including certainpurchase shares of our named executive officers,common stock at their election, sharesa purchase price equal to 85% of restricted stock purchased atthe lower of the fair market value as determined by our Board of Directors at the timeshares on the first business day of grant. We also have historically granted stock options and prior to our initial publicthe offering inperiod or the caselast business day of certain of our namedthe purchase period.

401(k) Savings Plan Our U.S. executive officers, at their election, shares of restricted stock purchased at fair market value, as determined by our Board of Directors at the time of grant on an annual basis as part of annual performance reviews of our employees. Beginning in 2017, our equity award grant policy also contemplates the grant of stock options and restricted stock units to existing employees, including our named executive officers,NEOs, are eligible to participate in connection with annual performance evaluations. Outstanding Equity Awards at FiscalYear-End

The following table sets forth certain information with respect to outstanding equity awards held by each of our named executive officers as of December 31, 2016.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Option Awards | | | Stock Awards | | Name | | Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable | | | Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable

(1) | | | Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexercised

Unearned

Options

(#)(1) | | | Option

Exercise

Price

($) | | | Option

Expiration

Date | | | Number

of shares

of stock

that

have not

vested

(#)(1) | | | Market

value of

shares of

stock that

have not

vested

($)(2) | | | Equity

Incentive

Plan

Awards:

Number of

unearned

shares or

options

that have

not vested

(#) | | | Equity

Incentive

Plan

Awards:

Market

value or

payout

value of

unearned

shares or

options

that have

not

vested

($)(3) | | | (a) | | (b) | | | (c) | | | (d) | | | (e) | | | (f) | | | (g) | | | (h) | | | (i) | | | (j) | | Ted W. Love, M.D. | | | — | | | | — | | | | — | | | | — | | | | — | | | | 4,019 | (4) | | | 58,075 | | | | — | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 267,856 | (5) | | | 3,870,519 | | | | — | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 125,890 | (6) | | | 1,819,111 | | | | — | | | | — | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 24,821 | (7) | | | 358,663 | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 99,285 | (8) | | | 1,434,668 | | | | | | | | | | | | Jeffrey Farrow | | | — | | | | 120,000 | (9) | | | — | | | $ | 14.96 | | | | 2/24/2026 | | | | — | | | | — | | | | — | | | | — | | | | | | | | | | | | Tricia Suvari | | | — | | | | 100,000 | (10) | | | — | | | $ | 18.25 | | | | 10/11/2026 | | | | — | | | | — | | | | — | | | | — | | | | | | | | | | | | Eleanor Ramos(11) | | | 47,500 | | | | — | | | | — | | | $ | 3.40 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | | 135,356 | | | | — | | | | — | | | $ | 0.49 | | | | — | | | | — | | | | — | | | | — | | | | — | |

(1) | All of the equity awards held by our named executive officers will accelerate and become fully vested and exercisable ornon-forfeitable if the equity holder is subject to an involuntary termination within 12 months after a sale event. The vesting acceleration of the equity awards held by our named executive officers is described in greater detail in “Employment Arrangements with Our Named Executive Officers—Change in Control Policy”. |

(2) | Computed in accordance with SEC rules as the number of unvested shares multiplied by the closing market price of our common stock on December 31, 2016, which was $14.45. The actual value (if any) to be realized by the officer depends on whether the shares vest and the future performance of our common stock. |

(3) | Computed in accordance with SEC rules as the number of unvested shares multiplied by the closing market price of our common stock at December 31, 2016, which was $14.45. The actual value (if any) to be realized by the officer depends on whether the performance milestones related thereto are achieved, whether the shares vest following achievement of the performance milestones, and the future performance of our common stock. |

(4) | Dr. Love purchased 21,428 shares of our restricted common stock under our 2012 Stock Option and Grant Plan (the “2012 Plan”) on September 4, 2013 in connection with joining our Board of Directors. Of this total, 25% of the shares of restricted common stock vested on September 4, 2014, and the remaining shares vest quarterly over the following three years thereafter, subject to Dr. Love’s continuous service through each such vesting date. |

(5) | Dr. Love purchased 714,285 shares of our restricted common stock under our 2012 Plan on June 11, 2014 in connection with the commencement of his employment as CEO. Of this total, 25% of the shares of restricted common stock vested on June 11, 2015, and the remaining shares vest quarterly over the following three years thereafter, subject to Dr. Love’s continuous service through each such vesting date. |

(6) | Dr. Love purchased 201,428 shares of our restricted common stock under our 2012 Plan on April 9, 2015 in connection with an annual replenishment grant. Of this total, 1/16th of the shares of restricted common stock vest on a quarterly basis from the vesting commencement date of April 9, 2015, such that all of the shares will be fully vested on April 9, 2019, provided Dr. Love remains in continuous service through each such vesting date. |

(7) | Dr. Love purchased 99,285 shares of our restricted common stock under our 2012 Plan on April 9, 2015. Of this total, 25% of the shares are subject to vesting upon the achievement of each of four (4) specified corporate operating milestones on or before certain specified dates, subject to Dr. Love’s continuous service through each such vesting date. On March 10, 2016 and September 29, 2016, the Compensation Committee determined that two of the four corporate milestones were met within the specified timeline and accordingly 49,643 shares of the restricted common stock in column (i) vested. In addition, one of the four corporate milestones was not met within the specified timeline and accordingly, 24,821 shares of the restricted common stock were cancelled during 2016. |

(8) | Dr. Love purchased 99,285 shares of our restricted common stock under our 2012 Plan on April 9, 2015. The shares will not vest until our market capitalization (determined based on the number of shares of common stock outstanding multiplied by the closing market price for our common stock as reported on NASDAQ) exceeds at least $2.0 billion for 20 consecutive trading days on or before the date twenty-four (24) months after the closing of our initial public offering (IPO), which was on August 11, 2015. |

(9) | Mr. Farrow received a grant of an option to purchase 120,000 shares of our common stock under our 2015 Stock Option and Incentive Plan (the “2015 Plan”) on February 24, 2016 in connection with the commencement of his service relationship with the Company, as an advisor. His full time employment with the Company commenced effective April 4, 2017. Of this total, 25% of the shares subject to the option vested on April 4, 2017, and the remaining shares vest quarterly over the following three years thereafter, subject to Mr. Farrow’s continuous service through each such vesting date. |

(10) | Ms. Suvari received a grant of an option to purchase 100,000 shares of our Common Stock under our 2015 Plan on October 11, 2016 in connection with the commencement of her employment. 25% of the shares subject to the option will vest on October 11, 2017, and the remaining shares vest quarterly over the following three years thereafter, subject to Ms. Suvari’s continuous service through each such vesting date. |

(11) | Dr. Ramos’ employment ended effective October 24, 2016. As of December 31, 2016, Dr. Ramos held outstanding stock options to purchase a total of 182,856 shares of common stock, and was entitled to exercise these stock options until ninety (90) days after her October 24, 2016 separation date under the terms of her Termination Letter Agreement with us. |

401(k) Savings Plan and Other Benefits

We maintain atax-qualified retirement plan, or 401(k) Plan, thaton the same basis as our other employees. The 401(k) Plan provides eligible U.S. employees with an opportunity to save for retirement on a tax advantaged basis. Eligible employees are able to defer eligible compensation subject to applicable annual limits of the Internal Revenue Code of 1986, as amended, (the “Code”) limits.or the Code. Employees’pre-tax contributions are allocated to each participant’s individual account and are then invested in selected investment alternatives according to the participants’ directions. Employees are immediately and fully vested in their contributions. Our 401(k) Plan is intended to be qualified under Section 401(a) of the Code with our 401(k) Plan’s related trust intended to be tax exempt under Section 501(a) of the Code. As atax-qualified retirement plan, contributions to our 401(k) Plan and earnings and matching amounts on those contributions are not taxable to the employees until distributed from our 401(k) Plan. In

Since December 2015, ourthe Compensation Committee has approved avarious matching contributions under the 401(k) planPlan. Under our current matching policy under which,approved by the Compensation Committee, effective as of January 1, 2016, subject to reassessment of the cap on matching for the calendar year thereafter,2018, we match in cash 100% of employee’s 401(k) contributions up to the first $500 and, thereafter, we match in cash 50% of employee’s first 6% of 401(k) contributions, subject to a cap of $2,500 per employee. In January 2017, our Compensation Committee approved a revised and simplified 401(k) Plan matching policy under which, effective as of January 1, 2017, subject to reassessment of the cap on matching for the calendar year thereafter, we match in cash 50% ofan employee’s 401(k) contributions, subject to aan annual cap of $2,500$5,000 per employee. We also pay, on behalf Perquisites Perquisites or other personal benefits are not a significant component of our employees,executive compensation program. Accordingly, we do not provide significant perquisites or other personal benefits to our executive officers, including our NEOs, except for limited travel stipends or limited housing and travel reimbursements for one NEO and certain other executive officers for recruitment and retention purposes. During 2019, none of our NEOs received perquisites or other personal benefits that were, in the premiumsaggregate, $10,000 or more for health, lifeeach individual, except Dr. Cathers, for whom we provided a travel allowance of $10,000 per month to cover travel between his residence and disability insurance.our corporate offices in South San Francisco. Employment Arrangements with Our Named Executive Officers

| Employment Arrangements with our NEOs |

Change in Control PolicyPost-Employment Compensation

We consider it essential to the best interests of our stockholders to foster the continuous employment of our key management personnel. In this regard,Accordingly, we recognizebelieve that reasonable and competitive post-employment compensation arrangements are an important part of an executive compensation program to attract and retain highly-qualified senior executives. While the Compensation Committee does not consider the specific amounts payable under these post-employment compensation arrangements when determining the annual compensation of our NEOs, we believe that providing our executives with post-employment payments and benefits in connection with a change in control are in the best interests of our stockholders because the possibility of a change in control and the related uncertainty may exist and that the uncertainty and questions that it may raise among management could result inlead to the departure or distraction of management personnelsenior executives to the detriment of the Companyour company and stockholders. In July 2015, our stockholders. In orderBoard of Directors adopted a change in control policy, which applies to our executive officers, including our NEOs, to reinforce and encourage the continued attention and dedication of certain key memberssenior executives in the event of management,a change in July 2015,control by providing these executives with certain cash payments, equity acceleration and other benefits upon a qualifying termination event in connection with a change in control. Additionally, prior to the January 2020 amendment of our Boardchange in control policy (which amendment is in the form of Directors adopted aour current Amended and Restated Severance and Change in Control Policy, whichas described below), our CEO was amendedentitled to certain post-employment compensation upon a qualifying termination event independent of any change in January 2016 (the “Policy”)control pursuant to the terms of his employment offer letter with us, as further described below under “Employment Offer Letters—CEO.” Pursuant to the Policy,our change in control policy, in the event the employment of any of our named executive officersNEOs is terminated by us or our acquirer or successor without Cause or an NEO resigns for Good Reason (as such terms are defined in the Policy)our change in control policy), in either case, within one year after the consummation of a saleSale Event (as defined in the 2015 Plan) (suchone-year period, the “Change in Control Period”), he or she will be entitled to receive the following payments and benefits, or CIC Benefits, subject to his or her execution andnon-revocation of a severance agreement within 60 days following the date of such termination, including a general release of claims: a lump sum cash payment equal to 12 months (or 18 months in the case of our CEO) of the NEO’s then-current base salary; a lump sum cash payment equal to 100% of the NEO’s target annual bonus for the year in which the closing of the Sale Event occurred, which, under our Amended and Restated Severance and Change in Control Policy, was increased from 100% to 150% in the case of our CEO; a lump sum cash payment equal to the prorated annual cash bonus payout of the NEO for the portion of the year in which the closing of the Sale Event occurred, based on the NEO’s annual cash bonus target and the date of termination of his or her employment or other service relationship with the company; if the NEO elects to continue his or her group healthcare benefits, a cash payment of an amount equal to the monthly employer contribution we would have made to provide the NEO with health insurance if | he or she had remained employed by us until the earlier of (i) 12 months (or 18 months in the case of our CEO) following the date of termination, or (ii) the end of the NEO’s COBRA health continuation period; and |